What is a structural deficit?

A structural deficit occurs when recurring expenses increase faster than recurring revenues. Although State law requires every city and town, except Boston, to prepare balanced budgets, there is no requirement that those budgets are “sustainable” or structurally balanced (i.e., where recurring revenues are equal to recurring expenditures in the budget).

Newton has a structural deficit

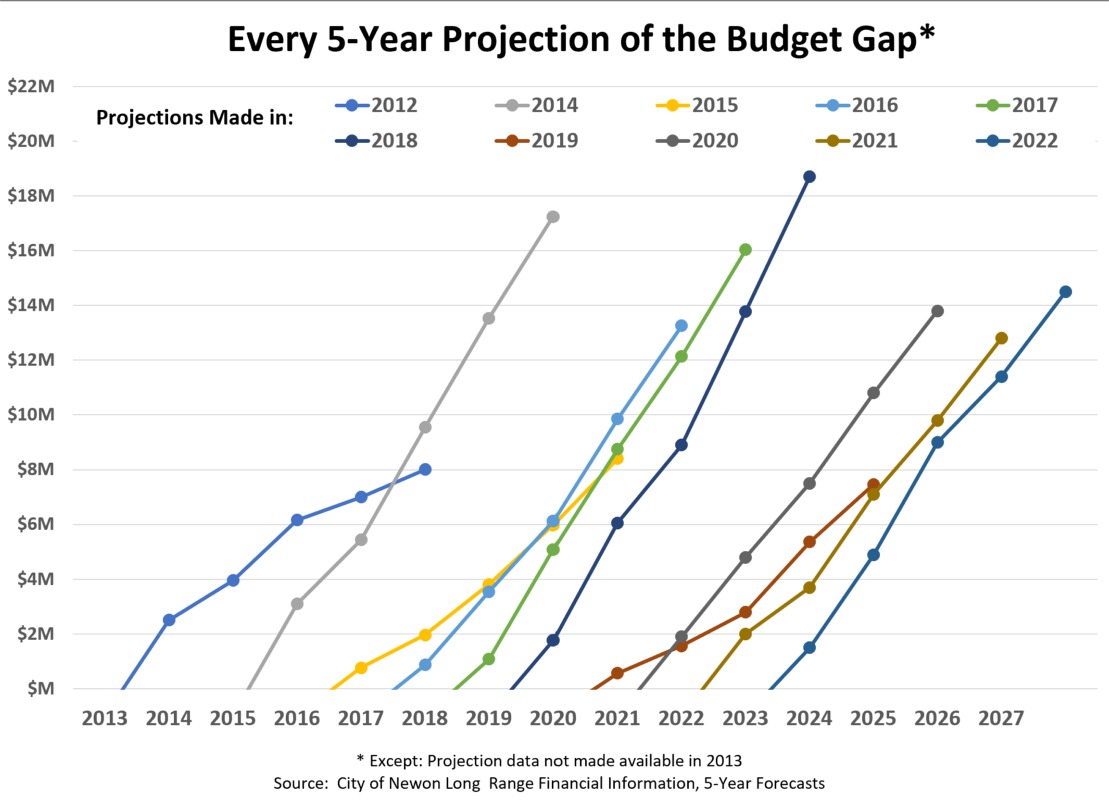

Each year the Mayor’s office prepares long-range forecasts to assist in planning the City’s future expenditures. As shown above, every 5-Year Forecast issued by the City’s Finance Department since 2013 has shown a balanced budget in that present year and then projected a rapidly growing budget deficit in the subsequent five years.

Mayor Fuller’s first Five-Year Financial Forecast in 2018 predicted very small gaps beginning in 2020 with a 0.13% gap and ending with a projected 1.52% ($7.46M) gap in 2024. At that time, the administration said, “If major new developments with positive net fiscal impacts or new industries like recreational retail marijuana are approved, there can be a positive financial impact.” (see 2020-2024 Five-Year Financial Forecast, pp. 37-38). The City’s Five-Year Financial Forecasts since then continued to project gaps.

Despite the approval of some major new development projects such as Riverside, Northland and Dunstan East, and the approval of recreational retail marijuana establishments, the City has not yet been able to reap significant fiscal benefit to cover the gaps predicted in the City’s Five-Year Financial Forecast.

What is driving the structural deficit?

Expenses: Salaries, Compensation, and Health Benefits for current and retired employees account for approximately 90% of the Newton Public Schools budget and 69% of the municipal budget. see City of Newton FY2024-2028 Long Range Financial Plan and 5-year Forecast. In addition, Newton self-insures and the cost depends on the market. More than 2,450 active employees and their dependents and more than 2,840 retirees and their spouses are covered.

Retiree Benefits: Pensions and OPEB are $52 million in the FY23 budget

- Pensions: The City’s long‐term pension and retiree health insurance obligations currently exceed $1 billion. The City’s Contributory Retirement Plan covers more than 3,460 current active employees, inactive participants,and retired employees and beneficiaries. State law requires municipalities to fully fund their pensions by 2040 but the City’s Retirement Board, with the support of the Mayor, has decided to save money in the long term by aggressively accelerating that schedule and fully fund the program by 2030, so the City can then begin paying into the OPEB (Other Post Employment Benefits) Fund. Currently, the plan for pensions is to increase the appropriation by 9.6% each year, and this year that was $38.6 million.

- OPEB: The Commonwealth prescribes the minimum percentage that a city or town must contribute towards retiree health insurance (50%) and the minimum level of benefits (Newton provides 80% for most of current employees). However, in contrast to pensions, the State does not yet require pre‐funding for retiree health and life insurance benefits.The Fuller Administration increased the percentage in the FY2019 Budget from 3.25% to 3.50% and then again in each budget thereafter (excluding the FY2021 Pandemic Budget). The appropriation in FY2023 for OPEB was $13.4 million.

Short-term strategies to address the structural deficit

There are several ways communities may immediately address gaps: Increase revenue either through an override or an increase in fees and fines, use Free Cash and Reserves, reduce expenses by cutting programs and services, or in Newton’s case, consider amending the pension funding plan. Each has limitations and advantages.

- Increase Revenues

- Operating override: Voters decide if they are willing to increase the tax baseline in perpetuity. If it fails, other sources of funds will have to be reviewed (including addition or increase in fees) to fill the gap or there may be a reduction in expenses.

- Increase fees/fines: The city can consider raising user and permit fees, for instance by instituting trash fees, increasing user and permitting fees, and increasing fines and penalties. Other sources of revenues, such as State and Federal Aid, are limited. The State recently released local aid estimates here.

- Use Free Cash, reserves, and/or one-time funds: The Administration states that these accounts help maintain the City’s Aaa bond rating, which is critical in allowing Newton to secure the best possible borrowing interest rates, leading to significant savings. In addition, the use of these funds are limited by the Financial Management Guidelines adopted by the City in 2011.

- Free Cash: As of December 2022, the City’s Free Cash position was $24,087,936. Application of the Financial principles suggest the City could use $1.5M as the general revenue source for the ensuing year’s operating budget, use funds to replenish reserve funds for the previous year, apply 40% to the Rainy Day Stabilization Fund, the remainder to use for one-time, non-recurring expenditures or in unusual economic circumstances, and an additional portion of Free Cash may be used for the ensuing year’s school or municipal operating budget.

- Rainy Day Stabilization Reserve: As of December 2022, the City’s Rainy Day Stabilization Reserve Fund was $24,195,383. Application of the Financial principles suggest that the City could use 25% or a more generous 33% in Rainy Day Stabilization Reserve Funds in a single fiscal year. NOTE: Appropriations may be made from the Rainy Day Stabilization Reserve Fund into the General Fund for operating purposes, upon recommendation of the Mayor and by a two-thirds vote of the City Council.

- ARPA funds: As of November 2022, uncommitted ARPA funds totaled $7,769,238 and the ARPA fund balance for committed projects (unspent but allocated funds) was $27,040,998. Newton received $63 million in ARPA funds, (one time funds to help communities that suffered/were hurt by the pandemic). Go here for list of ARPA investments. Although ARPA was used to fill past budgets (FY2023: $3 million, FY2022: $4.6 million) and the rest were spent on various projects and capital projects, the Mayor declined to fill an additional $1.4 million gap using ARPA funds, and the City Council voted against the Mayor’s proposed budget by a vote of 11 – 13.

- Reduce expenses

- Reduce the City’s Programs and Services and Personnel. The School Department has suggested that even with the passage of the override, the School Department will have a gap of about $2M. While reductions in personnel will be the last option, reductions in programs and services, as well as the introduction of user fees have been considered.

- Amend the Pension Funding Plan: The payment schedule can be changed but only by a vote of the Newton Retirement Board. In April 2020, the Newton Retirement Board approved the following motion unanimously: Vote to have the City’s Actuary prepare the 1/1/20 valuation report using a funding schedule that changes the FY2021 line item increase from 9.6% to 4.8% (all other assumptions remaining the same). This vote of the City of Newton Contributory Retirement Board of Trustees maintained the anticipated full funding of the City’s unfunded pension liability by FY2030 while fully funding the City’s OPEB (Other Post‐Employment Benefits) liability by the year 2045. However, that reduction in funding for FY2021 was only temporary. In FY2022, the Fuller Administration included the usual 9.6% annual increase as well as an additional 4.8% for a total increase of 14.4%, and resumed the prior approved FY2022 funding amount. The City is maintaining the 9.6% year‐over‐year increase, by increasing the FY2023 yearly contribution to $52 million.

Projected deficits continue even if the Override Passes

According to the Administration: “Even with the successful passage of the override, this forecast shows a deficit beginning in FY2025 of $1.5 million increasing to as much as $19.3 million in FY2030. A deficit of this magnitude has been included in Newton’s Long-Range Financial Plan for more than a decade. We acknowledge this gap. We will continue to manage our annual budgets and long‐term commitments to personnel costs, debt service, and new initiatives accordingly and will always have a balanced budget that ensures the financial health of the City. Revenues may be higher than expected throughout the next decade. If not, expenditures will need to be curtailed. In addition, unexpected cost increases may occur, also requiring cost-cutting in other parts of the budget.”

In addition, the School Department has stated that it will still have an approximate $2M gap and will have to look at “other” resources to help fill it.

Long-term strategies to address the Structural Deficit

In 2008, the same year that Newton voters “firmly rejected a proposed $12-million override, turning back a well-funded campaign that urged the city to raise taxes to pay for education and city services. “(see Boston Globe Updates), Mayor David Cohen’s administration established the Citizens Advisory Group (CAG) “to assist in planning for additional tactics and strategies to improve the City’s operational efficiency and effectiveness in future fiscal years including the functions of the Executive, School Committee, and Aldermanic branches of Newton’s government.”

The CAG released its final report and provided three solutions to what it identified as major issues:

- Acknowledge Newton’s Four Deficits: Operating and Capital budgets, Management and Communications Deficit

- Focus on the Nine Game Changers

- Reformulating the educational model in Newton

- Re‐engineering municipal operations

- Reducing the scope and scale of current services and programs

- Limiting the average, long‐run growth rate of employee salaries and benefits to the average, long‐run growth rate of City revenues, while maintaining a level of total compensation sufficient to recruit and retain excellent personnel

- Substituting user fees for tax‐based revenues in the financing of selected programs

- Taking on more funded debt

- Increasing municipal revenues through tax overrides or other means of raising monies

- Introducing a new Performance Management system

- Upgrading communications with Newton residents

- Communicate how Newton can, should, and will continue to be an outstanding City.

Many, but not all, of the CAG’s game changers were implemented under Mayor Setti Warren’s administration. Performance management was introduced, municipal operations were reviewed, tax override (operating and debt-exclusion) were proposed and passed, and employee salaries (through contract negotiations) were reviewed. After implementation of these initiatives, Mayor Warren, in 2016, declared the City of Newton was “well positioned for long-term financial sustainability.” Yet, even his 2017 – 2022 Financial Forecast showed a gap in the budget the very next year. It warned that in order for the budget and financial plan to remain sustainable, “the Administration must remain steadfast in its determination to balance revenue and expenditures while addressing infrastructure needs, providing for the functions of government, fully funding all liabilities, and developing and maintaining an appropriate level of reserves.”

He added, “Achieving these benchmarks are attainable as long as the City remains committed to and disciplined in its resolve to settle collective bargaining agreements that maintain parity between revenue and expenditures, follows the planned funding schedules for pension and O.P.E.B. liabilities, and remains vigilant in its oversight of every hard-earned tax dollar that has been entrusted to it in order to provide the level of municipal services that the people of Newton expect and deserve.”